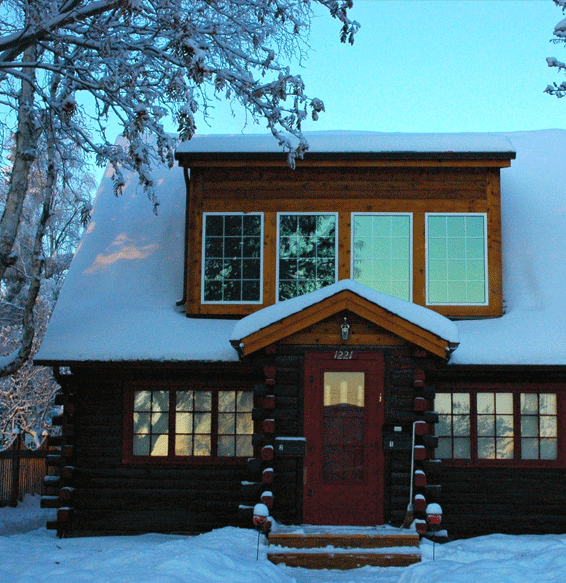

Alaska 1031 Exchange Investments

This type of investment is ideal for those looking to plan with tax and estate planning. This offers deferments for capital gains tax while offering protections for family ownerships. We help Alaska investors obtain 1031 Exchange properties with expert guidance, acquisition, management, and release. We are your partners throughout the entire process and structure of your investment.

Individuals, entities (like an s-corp), or partnerships can participate in the 1031 Exchange. The only stipulation is you need to use a qualified DST firm to help you acquire these properties and help you manage them. This is also their benefit, however. We identify investment properties in the Exchange, through data and analysis, and structure deals for maximum benefit. You also will not be managing these properties as you do traditional real estate investments. Our team handles each part of this investment structure until you sign the documents releasing it.

By working with an experienced DST firm, you get the confidence of knowing that you’re adhering to the rules and regulations of these complex investments.

If you are ready to learn more about Exchange real estate investments and are looking for tax deferment, we would love to see if you’re a match for the 1031 Exchange. Give us a call or connect with us today and learn more below.

Grow Wealth with DST

Alaska 1031 Structures

Property Qualifications

There are strict time frames that DST investors must adhere to, along with documentation, financial applications, and historical data required to participate. We have decades of data we work from to identify the right properties for our Alaska investors. This gives them confidence in their investments but also frees up cash for more 1031 investments if desired.

1031 Experience is a Pivotal Decision

- Experienced 1031 Exchange Advisors

- Risk and Benefit data calculations and considerations.

- Due Diligence Assessments for the best tax and estate planning.

- Experienced in finding the right 1031 properties for specific investors.

- Full management of investment, simplifying the investor’s participation.

Benefits of the 1031 Exchange

- Significant Tax Advantages – Deferring capital gains is crucial for investors who want to maximize profits and use them for estate planning purposes.

- Freed Cash Flow – Use your freed-up cash to make additional 1031 investments or put them towards other matched investments.

- Diversity and Simplification – Strategically use these investments to expand and streamline your investments, at the same time.

- Longevity – Best wealth-building investments start with the 1030 Exchange.

- Simplify Investments – Have a team help you acquire, manage, and sell your investments.

- Exchange Resource – Your source for the best Alaska 1031 Exchange investment opportunities.

MAKE AN APPOINTMENT REQUEST

Select which days work best for you, and we will get back to you. Mandatory fields are marked with an asterisk (*).