San Francisco 1031 DST Exchange Advisors

We haven’t been around since the beginning of the Exchange, created by Congress in 1921, but we have been successfully handling these real estate structures for decades. We have a brilliant collection of DST professionals who are experts at negotiating and managing 1031 Exchange investments in San Francisco. They are versed in the challenges that many real estate investors face and the profit liabilities that follow. Keep reading to learn more about how a DST investment (or several) can completely change your investment experience.

Top Advantages of Successful DST Investing

Less Profit Liability

Real estate is subject to various tax liabilities that can make the investment obsolete if you aren’t ready for it. The Exchange is different in that you can shield yourself from some of this taxation. Most notably, we are referring to capital gains tax. Since DST investments are longer-term investments, they are already taxed less. Since investment properties are taxed higher than your primary residence, investors quickly learn that their investment in real estate has to be incredibly strategic. DST Investing helps curtail some of this, where you buy and sell based on equal values. These smaller incremental gains protect from taxation that may otherwise wipe out real estate investments.

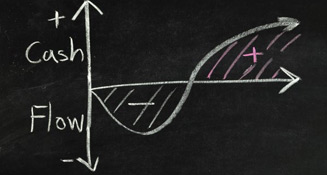

More Cash Flow

There are a few ways to free up cash within the Exchange, but you need to work with a qualified and experienced DST firm to achieve this. The IRS has a specific set of rules for DST investors, and it’s important to stay within their well-laid rules in order to benefit from these investments. It can be done, however, through strategic moves and refinancing. Free up cash flow and use it toward more DST investments that you can condense later. You can also use this cash flow for other aligned investments or primary property improvements when done after refinancing potentially. Your DST advisor can help you with your specific desires.

Estate Planning

Investors learn quickly how tricky estate planning can be as they move through various investment types. This can be a source of contention for many as they try to build wealth to protect their families in the future. Taxation is a sure thing, even after death, which makes estate planning frustrating. DST investing can help you avoid various estate planning barriers and leave your family with better wealth and fewer headaches. We will walk you through your specific situation. Suffice it to say the 1031 Exchange is a way to plan your estate with less liability for your family.

San Francisco

Highly Regulated Investments

You have to work with professionals to gain access to the Exchange, which is a bonus for you as an investor. These deals can get tricky and are highly regulated. There are specific timeframes that have to be adhered to. For example, you have only 45-days to find a replacement property(s) after selling yours. You have 180-days to close on that property. Also, these properties must be like-in-kind and of equal value. These are just some of the regulations, but not following these and the others can result in penalties and fines that no investor wants to tangle with.

New Tax Brackets

It likely comes to no shock that successful DST investing in San Francisco will come with profits that may slide you into a new tax bracket. It’s important to plan for these events, and you can do that more successfully with an experienced team like ours. We look at the entire financial picture, not just your DST investment property. Not preparing for a higher tax bracket can negate all the efforts you take within the 1031 Exchange. Our DST professionals can advise you and help you avoid or lessen this burden.

Not Tax-Free

DST investments are tax-deferred, not tax-free. This doesn’t have to be a pitfall if planned for correctly. If you have invested in any real estate in the past, you are familiar with how it impacts your tax structures. DST investing is no different, but it certainly can support you better than traditional real estate investments. These deferments are managed by your DST advisor, who is skilled at planning and avoiding tax liabilities.

Your Resource for Expert Guidance on DST Investing

We are an established and well-respected DST firm in San Francisco and have earned that through years of successful guidance and mindfulness among our clientele. We align your goals with appropriate properties rather than properties that stretch your risks threshold. We call this integrity because it’s a driving force behind what we do and how we treat each investor in our firm. We meet with our clients regularly to assess their investments and determine practicality, risk, regulations, or life changes. We spend countless hours educating, processing and timing our client’s investments to maximize their financial gains.

Finally, we handle several tasks for our clients, such as regulatory reporting, negotiations, matched investor relations, strategic forecasting, and analysis. We do this while working with your CPAs and other financial planners to ensure your investments stay on track and move in the right direction. In fact, we have resources if you don’t have a team of these people working with you. If you have questions about how DST 1031 investment can complement your portfolio, we would be happy to meet with you to discuss the journey. Call or message us anytime to set up your next wealth steps.