What is DST?

DELAWARE STATUTORY TRUST?

A Delaware Statutory Trust is a trust formed under the laws of the State of Delaware. Ever since the Internal Revenue Service has recognized Delaware Statutory Trusts as “like-kind” property for purposes of a 1031 exchange, Delaware Statutory Trusts have become more popular as real estate investment vehicles.

WHAT IS A

DEFERRED

SALES

TRUST?

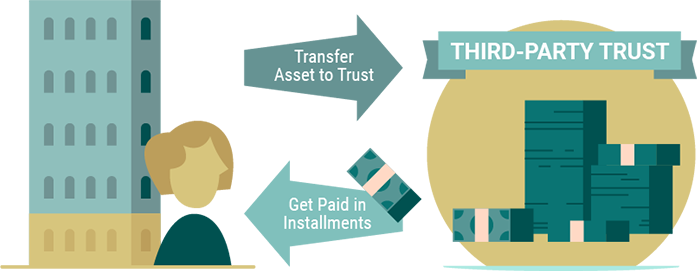

Once the trustee sells the property, the proceeds from said sale are distributed according to the terms of the installment sales contract or installment note. The terms of the contract and note are negotiated between the owner of the real property and the trustee. As such, the owner of the property is able to draft the payment plan according to his or her plan. This may include deferring payment until retirement and/or investing the proceeds accordingly.

WHAT ARE THE KEY DIFFERENCES?

While both the Delaware Statutory Trust and the Deferred Sales Trust can be great

real estate investment vehicles, there are several key and significant differences

between them. There differences include, but are not limited to:

The level of control over decisions made by the trusts through its trustees and/or agents differ between both trusts.

For Delaware Statutory Trusts, although you are considered an owner, you will not have control or have any say in the investment decisions. Delaware Statutory Trusts act through its appointed trustees and the trustees may also hire management firms to take care of and handle the properties. These trustees may also hire investment firms to handle the investment decisions or they can make the investment decisions themselves.

On the other hand, Deferred Sales Trusts are created with a specific goal in mind. As such, one is able to draft and negotiate a repayment plan with the trustee that achieves his or her short or long term goals. This could involve deferring payments until retirement or what happens in the event of death or incapacity.

Delaware Statutory Trusts are funded either through direct investments or through 1031 like-kind exchanges in order for the trust to purchase real property for the benefit of the investors. As such, there is a statutory deadline for a specific Delaware Statutory Trust to raise funds through investors. Once this deadline passes, the trust will not be able to collect and deposit additional investments. As a result, any revenue and profits will be limited by the initial investments.

Compared to a Deferred Sales Trust, the trust is designed to sell real property and use the proceeds according to the installment sales contract or installment note. The proceeds from any sale of the real property will be repaid accordingly. Additionally, depending on how the installment sales contract or installment note is drafted, the use and distribution of the proceeds may be modified or changed.

Under a Delaware Statutory Trust, you are considered a fractional owner of the trust and therefore a beneficiary. This means that the trustee and its agents are acting in your best interests by achieving the highest possible rate of return.

Under a Deferred Sales Trust, however, your relationship to the trust is that of a creditor. This is because your interest to the trust is to be repaid according to the installment sales contract or installment note. Like any creditor, your main objective is to ensure that you receive all the amounts you contracted to receive.

WHICH ONE IS RIGHT FOR ME?

Both Delaware Statutory Trusts and Deferred Sales Trusts have advantages and disadvantages. Deciding on which trust is right for you depends on your individual situation and goals.

While the rate of return for both trusts are within the range of 4-9%, it is important to note that your relationship and role will be different under each trust. A Delaware Statutory Trust may be better suited for you if you are looking for a passive income stream with minimal interactions with the trustee and its agents. If you want to be more active and dictate how the proceeds of the sale are used or disbursed, then a Deferred Sales Trust may be better suited.

HOW DO I

GET STARTED?

Deciding whether a Delaware Statutory Trust or a Deferred Sales Trust is better for you involves careful planning and consultations with experienced professionals. If you are interested in learning more about Delaware Statutory Trusts or Deferred Sales Trust or moving forward, we suggest contacting us for a consultation. An experienced professional will be able to assess your situation and help you decide which trust is best suited for you and your goals.

MAKE AN APPOINTMENT REQUEST

Select which days work best for you, and we will get back to you. Mandatory fields are marked with an asterisk (*).